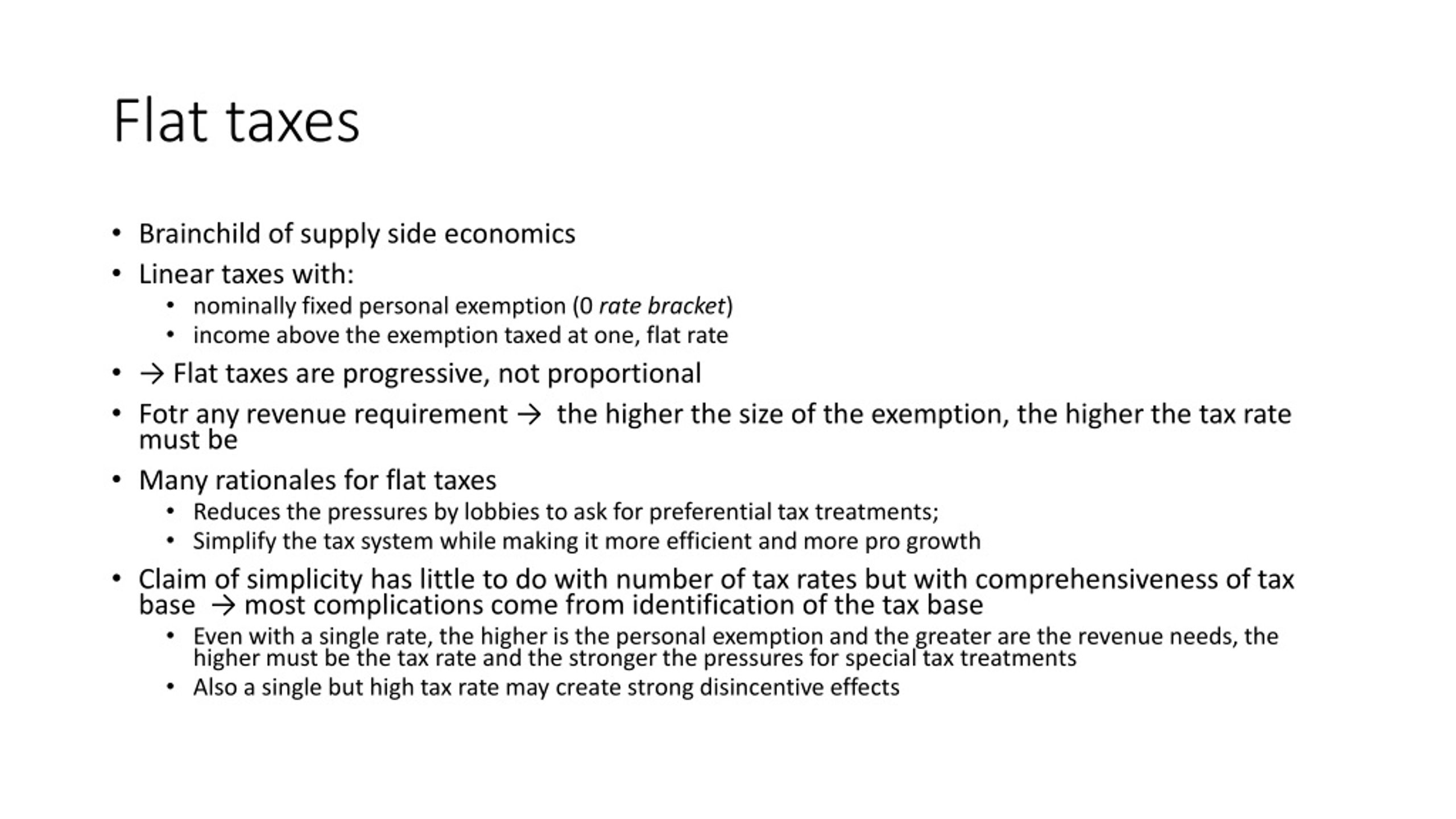

For the seventh year in a row, Estonia has the best tax code in the OECD, according to the freshly published Tax Competitiveness Index 2020. Tax Competitiveness Index 2020: Estonia has the world’s best tax system – no corporate income tax, no capital tax, no property transfer taxes. What is the best tax system in the world? Flat taxes are usually imposed on wages only, meaning that there’s no tax on capital gains or investments. Carson explained, that everyone would pay the same tax rate regardless of income (he suggested 10% since that “works for God”). What would happen if there was a flat tax?Ī true flat tax would mean, as Dr. No longer would the tax code penalize success and discriminate against citizens on the basis of income. A wealthy taxpayer with 1,000 times the taxable income of another taxpayer would pay 1,000 times more in taxes. You might be interested: What Is Sales Tax In Massachusetts? (Question) Who would benefit from flat tax?įairness. Both of these systems may be considered “fair” in the sense that they are consistent and apply a rational approach to taxation.

No one pays more or less than anyone else under a flat tax system. Is a flat tax really fair?įlat tax plans generally assign one tax rate to all taxpayers.

A flat tax also would eliminate virtually all compliance costs (e.g., monies paid to professional tax preparers) and reduce red tape significantly.

The first argument against the flat tax, one that resonates with homeowners, charitable organizations, and anyone with employer-provided health insurance or a pension plan, is the disruption that would come from trashing the current income tax system in favor of something untested and untried.Īdvantages of a flat tax For example, a flat tax system is much simpler than a progressive one, making it possible for all individuals to fill out their own tax forms. What are the arguments against a flat tax? And a flat tax could also give middle-class families an extra burden. A gradual tax system does allow for things like wealth redistribution, which many have argued is a major benefit to society. So, Why Not Move to a Flat Tax? In addition, a flat tax may not be as fair as one would think.

0 kommentar(er)

0 kommentar(er)